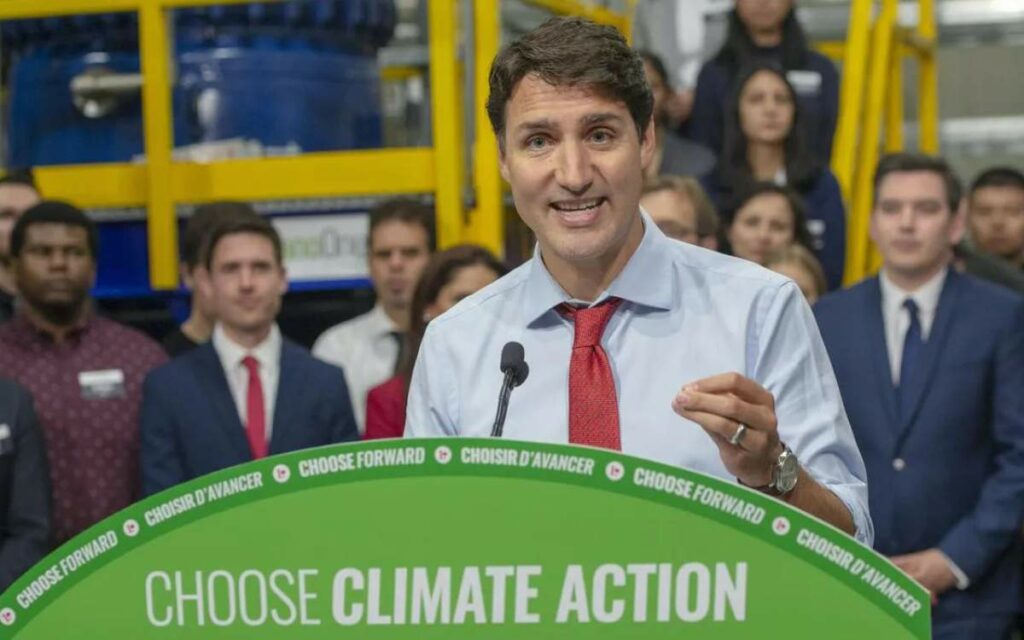

Filling up the tank at the pumps and paying the home heating bill is set to get a whole lot more painful, with Trudeau’s second carbon tax ready to come into effect July 1. Photo credit: The Canadian Press/Ryan Remiorz

We now know how much the Trudeau government’s carbon taxes will cost Ontario families once fully implemented: an average of $2,315 a year.

For the past five years, the feds have been peddling pure fiction on carbon taxes. The government’s line has consistently been that Canadians are better off financially with a carbon tax.

But Canadian taxpayers never bought the spin.

We all knew that no government introduces a tax that somehow leaves taxpayers better off. The Trudeau government consistently claimed that 80 per cent of families would get more money back through rebates than extra taxes paid due to the carbon tax.

The Parliamentary Budget Officer, an independent and non-partisan parliamentary watchdog, has consistently shown that households are seeing net losses from the carbon tax. In 2023, the average Ontario family is set to lose $478, even after the rebates.

And the plans the Trudeau government has in store for the carbon tax will make this year’s losses look like walk in the park.

The Trudeau government plans to hike the carbon tax every year between now and 2030. That means the carbon tax will triple. The government also plans to introduce a second carbon tax in July. The second carbon tax, known in government lingo as the “clean fuel standard,” will add another 17 cents per litre to the price of gas by 2030 and doesn’t come with any kind of a rebate.

Filling up the tank at the pumps and paying the home heating bill is set to get a whole lot more painful.

The PBO says once the Trudeau government is through with all the carbon tax hikes it has announced thus far, the average Ontario household will be losing a net amount of $2,315 a year. That’s nearly two months’ worth of groceries for the average family of four.

Taxpayers simply cannot afford Ottawa’s reckless carbon tax. No less than 53 per cent of Canadians are also telling researchers that they are living $200 away from financial insolvency. And one in five Canadians are skipping meals because they’re already stretched to the max.

Do a little arithmetic and the damage carbon tax hikes will do to Canadian families going forward is clear for all to see.

This year, the carbon tax is costing Ontario families a net amount of $478. That’s a cost of roughly $40 per month. But by 2030, Ottawa’s carbon taxes will be costing Ontario families roughly $193 a month.

Given that more than half of Canadians are just $200 away from insolvency, the extra burden of yet another $193 per month could drive many Canadians to the brink.

For those who do manage to scrape by, there’s a good chance these extra costs will lead to even more credit card debt. The average Canadian owes over $21,000 in non-mortgage debt. Ottawa’s lust for higher carbon taxes will drive this from bad to worse.

And despite all this financial hardship, there’s little proof that carbon taxes even work. For years, British Columbia had the highest carbon tax in Canada. Yet, the province’s emissions have increased steadily since 2015. Nova Scotia, on the other hand, didn’t have a punitive carbon tax, and yet the province’s emissions have gone down.

It’s time to bust some myths. The truth is Canadians are not better off with the carbon tax. The tax isn’t affordable for families. And there’s no proof that carbon taxes will help the environment.

With a carbon tax tsunami on the horizon, it’s time for taxpayers to demand that the Trudeau government reverse course. Canadians cannot afford Ottawa’s punitive and reckless carbon tax.

Jay Goldberg is the Ontario Director at the Canadian Taxpayers Federation. He previously served as a policy fellow at the Munk School of Public Policy and Global Affairs. Jay holds a Ph.D. in Political Science from the University of Toronto.