In the U.S., public sector pensions are one of the items that are deservedly coming under the microscope. Photo Credit: Pexels

The longstanding issue of unsustainable public sector pensions is not getting any better. In fact, it is getting worse – much worse – as the current financial state of these pensions and demographic trends demonstrate. This has been predicted for some time, as anyone who has a basic understanding of Canada’s history with public sector pensions well knows.

Most of these pensions, which can be found in virtually all government workplaces at federal, provincial and municipal levels, were established back in the early 1960s. At that time, most people lived until the age of about 70 and early baby boomers were just starting to enter the workforce so that there were many workers contributing to these pensions and comparatively few pensioners collecting a pension.

How times have changed! These days, it is not unusual for people to live well into their 80s and even 90s, so those pensions must now be paid out for much longer than originally planned. As well, subsequent generations have not been as large as the boomers so there are fewer employed people paying in to the pensions to ensure their financial sustainability. The Ontario Teachers’ Pension Plan (OTPP) is a good example where, in the 1970s, there were 10 working teachers paying in to the plan for each retired teacher collecting a pension. Now, the ratio is closer to one teacher working for one retired teacher collecting. Not surprisingly, taxpayers have been required to ante up more and more money to contribute to these pensions as a result.

The public sector is dominated by so-called defined benefit (DB) pensions – the gold-plated pension standard which pays out a fixed amount (typically also indexed to inflation) no matter whether the investments involved increase in value or not. DB pensions used to exist in the private sector as well but have gone the way of the dodo as they became financially unsustainable. Unlike governments, private companies must compete to stay alive, and as life expectancies grew and demographic realities came home to roost, few private firms could continue to afford to offer these very costly pensions and still remain competitive in the marketplace. As a result, the only DB pensions that still exist are largely in government, where the big base of taxpayer dollars can be expected to be tapped into to prop up what would otherwise collapse.

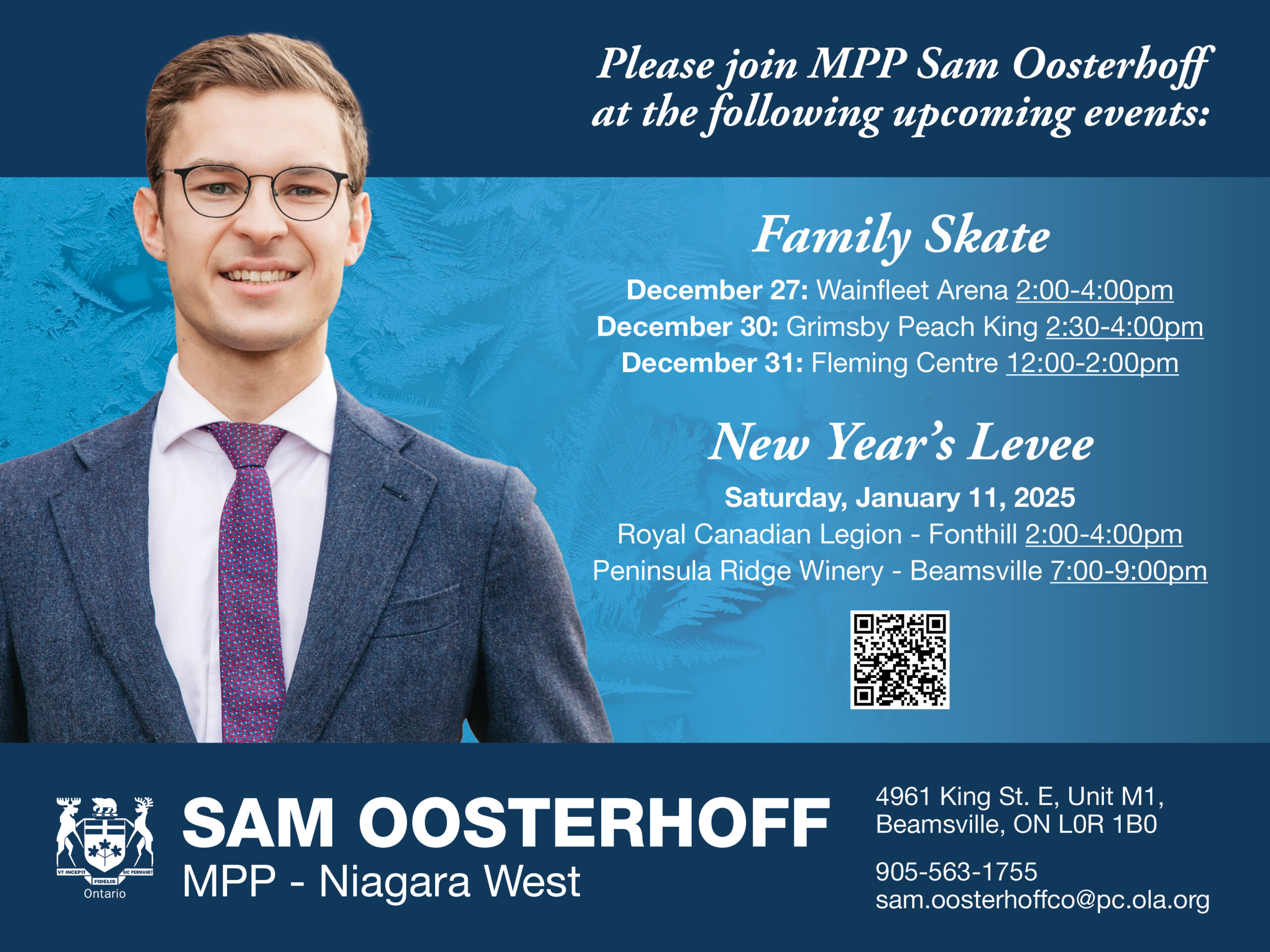

This ongoing reality has once again hit the headlines for a number of different reasons. The election of the Trump government south of the border has prompted a closer examination of what is happening with the U.S. government pensions that are just as out-of-control as their Canadian counterparts. The fact that these pension funds are largely controlled by the Big 3 investment companies – BlackRock, State Street and Vanguard, has been a regular concern of financial guru Vivek Ramaswamy. Ramaswamy has been tasked by Trump, along with Elon Musk, with finding efficiencies in government, and public sector pensions are one of the items that are deservedly coming under the microscope.

In Canada, the recent abrupt dismissal of senior management at the Alberta Investment Management Corporation (AIMCo) by the Danielle Smith government has attracted attention. As with many other pension management organizations, AIMCo has in recent years devoted resources to establishing departments to oversee things like ESG (environment, social and governance), DEI (diversity, equity and inclusion) and other woke objectives that add management costs but do nothing for investment returns. Furthermore, AIMCo and other similar entities, including the federal Canada Pension Plan investment board (CPPIB), have permitted political considerations to impinge on their investment priorities. The key goal of any pension fund, especially pension funds that are managing taxpayer dollars, should be to maximize investment returns, not cave to partisan political preferences.

The Canadian Infrastructure Bank (CIB) has also been a regular focus of criticism, and deservedly so. There was no reason for the creation of this additional bureaucracy, as the federal government did not lack for ways to invest in infrastructure prior to its creation. The CIB came into being in 2017 with $35 billion of Canadians’ tax dollars and has had a history of failure. Its major success has been paying excessive salaries to a number of executives who never seem to stay very long. It is also viewed as a means of propping up the abysmal finances of public sector pensions by guaranteeing larger rates of return to these pension plans when they “invest” in projects the CIB undertakes. The only reason the CIB can offer these high rates of return is that they are subsidizing them via taxpayer dollars. In other words, the CIB enables taxpayers to pump even more money into gold-plated public sector pension than they already do. What an outrage.

The challenge for average taxpayers is that pension issues are complex and transparency of the status of many public sector pension plans is poor. As with all looming issues that are not in the top few priorities, governments continue to want to bury the pension issue, hoping it will not blow up on their watch but rather in the face of a future government.

In a number of public sector worker strikes and other protests, it is not unusual to hear the refrain “hands off our pensions” from union members. Many Canadians might well have sympathy with this position, until the facts are made clear. Indeed, all Canadians who are private sector taxpayers – about 75 per cent of us – should be saying “hands off our pensions,” as the billions of our tax dollars that end up in the pension funds for government workers mean that a majority of Canadians can’t afford to put aside enough money for a decent retirement for themselves. And we certainly can’t afford to put away anywhere near the amount of money it would take to have the rich, indexed pension of a government employee.

This is unfair, dead wrong and financially unsustainable to boot. As lifespans continue to increase and demographic trends work against the financial viability of these pensions, serious change is needed. A fair transition of these pensions to a defined contribution (DC) basis, where pension payouts depend on the employer’s ability to pay, can be accomplished with the necessary political will on the part of governments. What is also needed is a better understanding of the scope of the problem by a majority of citizens, and how much it is costing those of us who don’t work in government in terms of their own standard of living and retirement.

Canadian governments have been far too cowardly to take on the public sector unions and the increasingly problematic pension issue to date. Hopefully, more focus on public pensions south of the border will encourage some positive change in Canada as well, before the financial unsustainability of these pensions completely implodes or private sector taxpayers are bled to death.

Last Updated: November 22, 2004, 10:25 pm

She has published numerous articles in journals, magazines & other media on issues such as free trade, finance, entrepreneurship & women business owners. Ms. Swift is a past President of the Empire Club of Canada, a former Director of the CD Howe Institute, the Canadian Youth Business Foundation, SOS Children’s Villages, past President of the International Small Business Congress and current Director of the Fraser Institute. She was cited in 2003 & 2012 as one of the most powerful women in Canada by the Women’s Executive Network & is a recipient of the Queen’s Silver & Gold Jubilee medals.