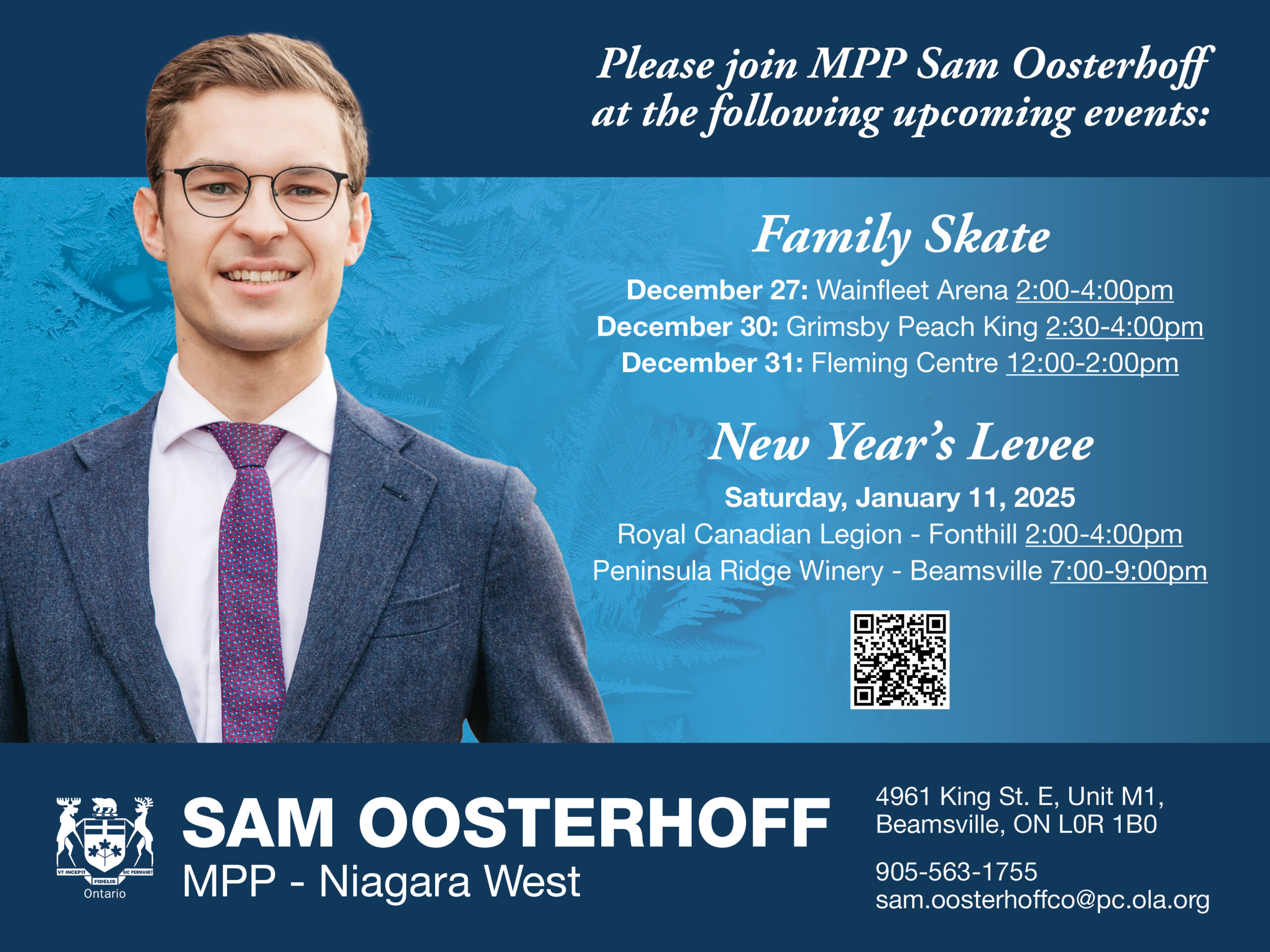

All indicators point to more tough times ahead for the backbone of Canada’s economy. Photo credit: Pexels/Tim Douglas

Some recent data from various sources indicate that Canada’s small business community has yet to recover from the impact of the pandemic. As this sector represents about half of the economy, this is not a trivial thing and should be of concern to all Canadians. Information from the federal government’s Small Business Financing Program indicates that there has been a significant increase in the number of applications approved over last year.

These data confirm more small businesses have gone deeper in debt. The federal loan guarantee program shows applications approved last year jumped 34 per cent. These loans are delivered through the banking system, but are expensive for the business owner as they charge the prime rate plus 3 per cent, which is now about 10 per cent total at current interest rates.

If a small business can avoid paying this much, they certainly will, and the sharp increase in these loans show how many businesses are having trouble getting regular and cheaper financing at financial institutions. The average amount of the loan was about $250,000, an increase of about 5 per cent from the previous year, yet another indication of troubled finances as well as the impact of inflation.

Another pandemic-related negative is the fact that the Canada Emergency Business Account (CEBA) loans that were extended during the pandemic by the federal government are coming due on January 1, 2024. Small firms that used these loans are starting to panic about the need for repayment at a very difficult time for the economy. Some financial institutions have been offering to take over these loans for small businesses, but often the terms are not favourable for the business. Although this might seem to be a lifeline, small businesses should be careful about switching these loans to chartered banks or other financial institutions before examining their options.

With the current state of the small business community far from robust, the fact that most analysts expect a recession of some duration in the next few months is hardly encouraging. Although all businesses are affected by an economic downturn, small businesses tend to suffer the most as they have smaller profit margins than larger firms, less capital reserves, and worse treatment by financial institutions.

However, research shows that smaller businesses also tend to hang on to their employees in tough times as they usually know them personally and feel more of a responsibility to them, unlike large businesses which typically lay off large amounts of employees in difficult times. This is one of the reasons that small businesses are such an essential component to any healthy economy.

Another complicating factor is that, just like every other part of the economy, there is a significant chunk of small business owners who are baby boomers and currently looking to retire. Passing on a business is a challenging affair, and many small business owners just close down their businesses if family members or others cannot be found to take over the business. This will worsen an economic downturn as a significant number of smaller firms disappear completely, along with the jobs they provide.

Throughout the pandemic, most governments treated smaller firms abysmally. Ontario was particularly bad as it forced the closing of small firms while permitting larger businesses like Walmart, Costco, etc. to remain open. There was absolutely no sensible reason for this, as the notion that a handful of customers in a small firm would be more likely to transmit a virus than hundreds crowding together in a large store was ridiculous. Yet it seemed that the larger firms must have just had better lobbyists to permit their operations to continue while those of smaller businesses could not.

Post-pandemic analyses have also shown how the closures of businesses were completely useless. At this point, considering the state of the vital small business community, the least governments across Canada could do is lessen the burden on small firms by reducing their taxes, streamlining the costly red tape that all governments impose on business, facilitating financing or other means to support them. Considering the massive contribution small business make to the country, this shouldn’t be too much to ask.

She has published numerous articles in journals, magazines & other media on issues such as free trade, finance, entrepreneurship & women business owners. Ms. Swift is a past President of the Empire Club of Canada, a former Director of the CD Howe Institute, the Canadian Youth Business Foundation, SOS Children’s Villages, past President of the International Small Business Congress and current Director of the Fraser Institute. She was cited in 2003 & 2012 as one of the most powerful women in Canada by the Women’s Executive Network & is a recipient of the Queen’s Silver & Gold Jubilee medals.