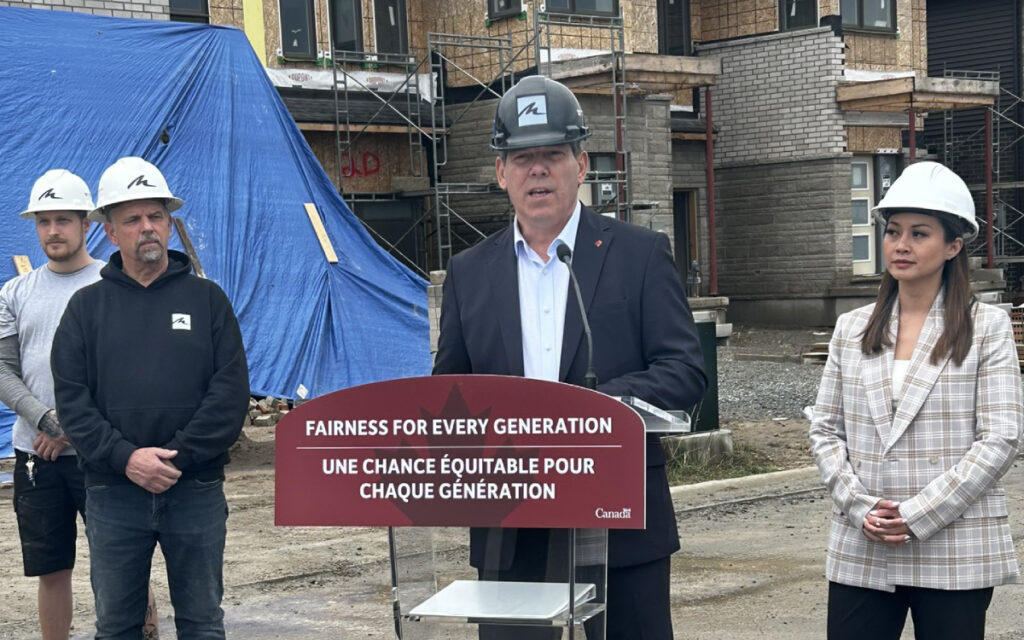

Many of the Trudeau government’s critics suggest that all this announcement will do is lead to Canadians taking on even more debt and does nothing to solve the housing crisis. Pictured: Minister of Small Business Rechie Valdez and MP Vance Badawey. Photo Credit: Vance Badawey/X.

Canada’s Minister of Small Business, Rechie Valdez, was in Niagara Region last week announcing new housing initiatives promoted by the Trudeau government ahead of the federal government’s 2024 budget, which is set to be released this week.

Valdez was joined by Niagara Centre Liberal Member of Parliament Vance Badawey. The announcement was made in Welland.

Valdez and Badawey announced the Trudeau government plans to allow for 30-year amortization periods for new mortgages issued to first-time homebuyers. The policy will take effect on Aug. 1.

Prior to this announcement, mortgages in Canada have been limited to a 25-year amortization period.

Badawey claims the announcement will “help residents of Niagara Centre by making life more affordable.”

The new policy is a controversial one. Many of the Trudeau government’s critics suggest that all this announcement will do is lead to Canadians taking on even more debt and does nothing to solve the housing crisis.

Still, the announcement was applauded by some, including the Canadian Home Builders’ Association.

“This measure will go a long way to enable our sector to respond to the government’s goal of getting 5.8 million homes built over the next decade,” said the Canadian Home Builders’ Association in a statement.

The announcement of a longer mortgage amortization period is one element of a suite of announcements made by the Trudeau government on the housing file ahead of Finance Minister Chrystia Freeland’s budget.

An additional announcement focused on allowing homebuyers to access more of their retirement savings to help make a down payment. Withdrawals from RRSPs will now be capped at $60,000, up from a previous limit of $35,000.

The federal government is also touting its First Home Savings Account, which allows homebuyers to save money for up to 15 years once they open the account, tax free.

The biggest ticket pre-budget item announced so far is a $6-billion fund, called the Canada Housing Infrastructure Fund, which will help municipalities with upgrading water infrastructure and other important utility functions.

More money is furthermore being put into the federal government’s Housing Accelerator Fund: an additional $400 million over three years.

The Trudeau government has been scrambling to address Canada’s housing affordability crisis, as polling shows widespread dissatisfaction with the Liberal government’s handling of the file. These new announcements are part of a 28-page plan to address Canada’s housing supply shortage.

Conservative leader Pierre Poilievre has put the issue of housing supply front and centre in his party’s effort to unseat the Trudeau government.

Even though Trudeau claimed just months ago that housing was not primarily a federal government policy concern, the feds appear to be placing the issue of housing at the centre of the government’s 2024 agenda.

Jay Goldberg is the Ontario Director at the Canadian Taxpayers Federation. He previously served as a policy fellow at the Munk School of Public Policy and Global Affairs. Jay holds a Ph.D. in Political Science from the University of Toronto.